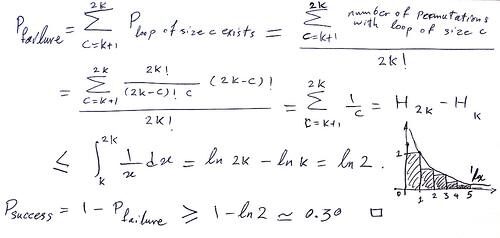

I do my best to avoid complicated mathematical formulas (like the one featured above). In my experience, mathematicians do a great job of taking a relatively simple process and making it overly complex by applying a series of inexplicable formulas. I guess that’s why I was happy to run across an interesting concept the other day called “the multiply-by-25 rule.”

The idea is that you can estimate how much is needed in savings to generate enough income to pay for an item. The only factors you need to know are how much something costs you now, and at what interest rate your money will grow. Of course, determining both in this period of a inflation and fluctuating interest rates is tough, but you can get a general idea of how the math works by looking at a real-life example.

Photo courtesy of Behdad Esfanbod

A Working Example

We are fans of Netflix because it offers a relatively frugal entertainment option for family movie nights. It’s cheaper than going to the theater, and cheaper than an expanded cable package. At roughly $9 a month, our Netflix membership sets us back $108 per year. To continue paying for Netflix out of passive income earning 4% per year, I would need a $2,700 ($108×25) savings balance. Since most of my savings are now earning closer to 3% I would need to multiply my costs by a factor of 33.33% (100/interest rate). This increases the amount needed to pay for Netflix after reaching financial independence by $900 to $3,600. Maybe I should just cancel Netflix!

A Bigger Example

I have heard stories of people paying off their homes, cars and all other debts and living quite comfortable on a couple thousand dollars a month, or less. Assuming our goal is the high end of that estimate, how much of a savings balance would be required to spin off $24,000 a year in income?

If earning: 3% interest, you would need $800,000 4% interest, you would need $600,000

5% interest, you would need $480,000